13 Nov 5 tips to succeed in planning the annual report (template)

This piece will cover the following:

- Are you the project lead for planning the annual report?

- Tip 1: Start early

- Tip 2: Include people with Annual Report experience

- Tip 3: Present your data visually

- Tip 4: Include your CEO’s statement letter

- Tip5: Ensure you have dataflow processes in place

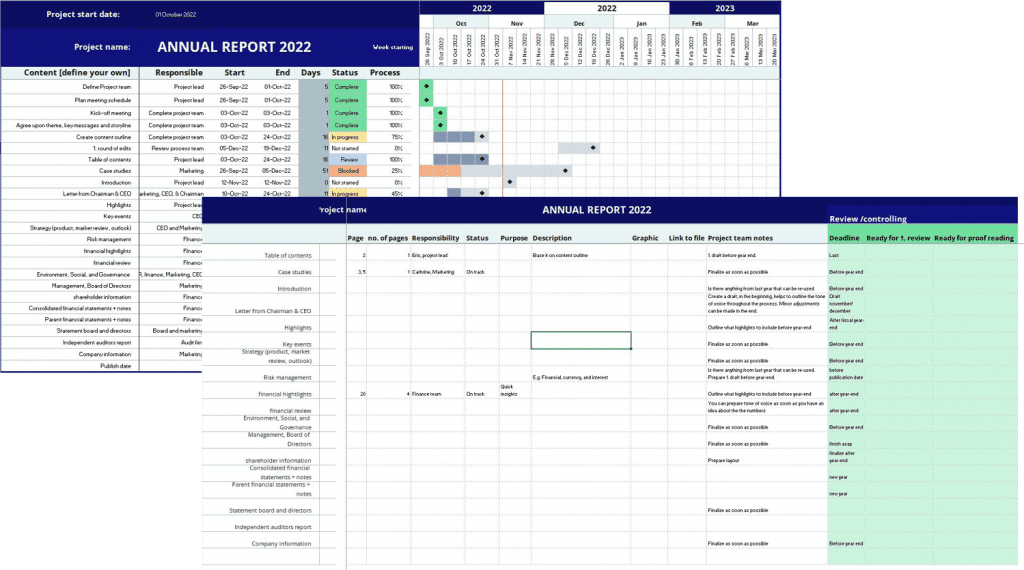

- Download project template with timeline [Excel]

Are you the project lead for planning the annual report?

For many finance professionals, the annual report is approaching. And compared to other financial reports, this report demands attention and information from more people than finance. Trying to get everyone aligned and ensure that nothing will be rushed can seem overwhelming, even for the most experienced finance professionals. The following five tips originate from our own company experience, an insight into learnings from our customers, and inside knowledge from years in the finance industry.

Tip 1: Start early

When to start the process depends on when your fiscal year ends. For many finance departments, it follows the year, and those of you will already have begun the process. Maybe you have too. If not, then now is the time. If there is one key element to remember: The annual report needs more than finance!

If you have a deadline mid of February, we will recommend a start in mid-October; it is always better to be prepared and be ahead. Everyone working on the annual report will still have their daily tasks, meetings, and ad hoc deliverables – starting early, you can minimize delays and adequately plan the process.

So, collect your team, and get ready for kick-off.

Tip 2: Include people with Annual report experience

Before starting, it is a good idea to look into agencies, strategic partnerships, consultants, or other people who have experience with the Annual Report. These experienced people are valuable in this process. They will have all the knowledge you need about the stakeholders and the requirements the annual report needs to make an impact. You know the numbers, but the value is more than the financial statements –sometimes, we forget that in finance.

The annual report is more than just a regular financial report. It is one of the most read documents, especially by investors, so there is no room for mistakes. Therefore, you need people with experience who can write and influence the project’s direction. But also help to ensure you reach deadlines and align all efforts with the goal – all the way through.

Tip 3: Present your data visually

Looking back at earlier annual reports, how have you presented the data? It might not be a top priority usually, but maybe it should. The annual report is a heavy document, and in a world where we constantly consume much information, how we present it becomes a critical factor.

Therefore, include people who know color use, which sections to highlight, and language use (is it easy to read). Their fundamental purpose should be to ensure that the company’s overall presentation tells the right story. You can compare this document to a brand credibility presentation – the information it contains will feed into other communication documents throughout the year. Just think of your investor presentations, strategy, and quarterly reports.

And if you do it right, you can reach more than investors by showcasing vision, results, employees, case studies, ESG efforts, and strategy. Remember, it is not just your investors who read the annual report but also new employees, partners, customers, and more.

Tip 4: Include your CEO’s statement letter

Guess which part of the annual report is primarily read. You would think it was the financial statement. But frankly, it is the letter from the CEO. Therefore, start to use it to your own advantage.

A tip is to start this draft as early as possible, as it can also help to set the tone for the entire Annual Report. Ensure it contains recent initiatives, vision, values, and thought leadership – all you want to see from a good leader.

Note: a visionary is excellent, but a realistic and grounded one is better.

Tip 5: Ensure you have data flow processes in place

What is your process for collecting data across the organization? If you all share the same excel sheet, try to look into how much time you use on error-tracking. This result should guide you in deciding whether you need automated processes to minimize time spent on this. If there are one thing auditors and the audience do not like. It is finding errors in the numbers after the publish date.

If you always have these tips in mind before the kick-off meeting, you will already have an excellent start to the project.

Do you review and take a long, good look at your annual report process every year? Without an actual project plan and strategy, things can get messy, rushed, or in the worst case, error-filled. And it can be nearly impossible to correct those after publishing the annual report.

We have put together a checklist of what to remember before starting, the essential elements, and a project plan template you can use or edit as it fits your company. Whether you are new to the role of project lead for the annual report, new to the team, or just seeking inspiration on how other companies are planning their process, this blog is for you. Read the group CFO’s Checklist here.