29 Oct Cash Flow: The good friend of the proactive group CFO

“We want to enable the company to grow faster and improve profitability.”

Do you recognize this goal from your group finance department?

When managing the Group’s finance, the CFO must ensure that funds are always available in detail and have total control over the finances. Here, the Cash Flow statement becomes the proactive CFOs helping hand, as well as the finance controller’s working document. But still, we see too many groups neglect this statement, either ending up with hidden errors or, worse, losing their overview of the company’s working capital because it is perceived to be too complicated.

Cash flow: the critical indicator

Cash flow is one of the most critical indicators of a business’s performance. With a positive cash flow, the company can meet its obligations promptly without borrowing money. However, problems arise when a company does not have enough money to cover its debts as they become due. While this is normal occasionally, a consistently negative cash flow is a red flag and should immediately alarm management to act.

If you are honest, how much do you use your cash flow to predict future strategies and improve profitability? Or are you primarily using it ‘just’ as a part of your mandatory reporting and therefore end up cutting corners?

A proactive CFO wants insight into the company’s numbers and effectiveness to enhance the overall company profitability and strategy. It is here that knowing your cash flow, where to put a lid on costs, and following up on debitors becomes an excellent source for the strategic CFO. It makes it possible to look into areas that will result in increased liquidity for the entire Group and subsidiaries, like:

- Pricing strategies

- Collections

- Markets

- Payment terms

- Budgeting and forecast

Furthermore, maintaining a steady cash flow puts your business in a stronger position to grow revenue. A good Cash reserve enables you to expand into markets, innovate your product offers or hire new people.

Don’t cut corners in your cash flow

At Konsolidator, we talk with many group finance teams of all sizes and complexities. In our experience, it is rarely because the CFO or the finance controller doesn’t understand the value of Cash Flow, but because of its reputation as complex. To be fair, it is complicated if you have never done it before. But that doesn’t mean that it is not worth learning. It is an excellent controlling aspect where you catch mistakes you don’t see by just looking at your statement. This alone should be a reason for groups to stop cutting corners. Whether you are a small or large group, don’t fall into these two common reasons for neglecting your cash flow:

Small- and medium-sized groups

Small- and medium-sized groups might be inclined to say it is easier to look at their bank account than to learn to do it properly. And in many instances, it is true; it is easier. However, not doing it regularly and delaying learning puts your company at greater risk in uncertain times. And as a small company, the consequences can be massive. Furthermore, what is easier, is to create a cash flow statement for a small group compared to a larger one. So, if you are planning to grow, why wait until it gets really complicated?

Large groups

Large groups tend to only create a Cash Flow Statement on the parent company, resulting in no deep insight into the subsidiaries’ cash movement details. It is almost impossible to avoid errors if you skip creating a cash flow on the subsidiaries before consolidating them. And we see this regularly. Alone for the compliance and controlling aspects, the Group should have a more thorough Cash Flow process.

Whether the size of the Group, balancing your in- and outflows of cash will ensure a smoother day-to-day running of your business while building sufficient reserves to stand against harder times. Additionally, by not making common mistakes, you maintain an overview of the development of Working Capital, including actual numbers, budget, and forecast.

Fx adjustments – a troublemaker for correct numbers in your Cash Flow

Something we often see becoming a trouble maker for the Group that wants to deliver correct numbers is how they translate Cash Flow from local currency to group currency. The common challenge is that many groups do not use debit/credit to calculate cash flow. Instead, when calculating, e.g., inventory, they apply one exchange rate at the beginning of the year and another at the end of the year, not counting for the fluctuation of the foreign currency. As a result, if the inventory started on 100 and ended on 100, the number might still differ because of the two time periods. On the other hand, a debit/credit method will apply the group currency to the difference in the ‘actual’ value of the inventory, in this case, 0. By changing this small part, you can already remove one irregularity in your reporting.

Make Cash Flow a part of your Monthly Reporting

If you have ever made a wrong call due to not knowing where your cash was floating out of your Group, then don’t take this habit into your accounting manners. Get started on a good Cash Flow Statement as part of your monthly consolidation. Besides knowing that you deliver a correct cash flow and ensuring compliance with industry and legal standards, there are many reasons to incorporate a monthly Cash Flow statement in your reporting. Thereby, you can quickly determine, for example, why, where, and when your debitors are increasing and fix this ongoingly.

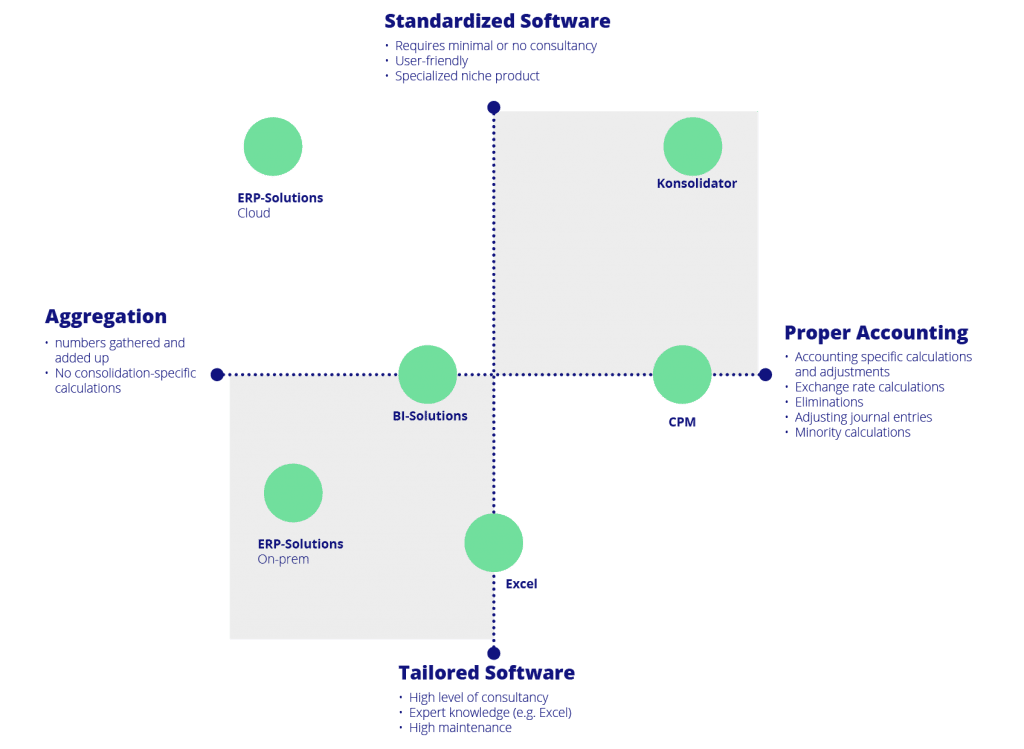

We recommend using consolidation software to avoid unintendedly making mistakes in your last-minute cash flows and the group spending money they do not yet have. There are many advantages of an actual system vs. a spreadsheet solution, but mainly to ensure correct data flow from all groups and translate your Cash flows into budgets and forecasts for the following year. Even for SMEs, we believe the advantages of using a consolidation system for cash flow outweigh the costs. If you have just a few consolidated entities in your Group, chances are that the cash flow is not embedded in daily routines.

If we can help or advise you with a practical walk-through of how to set up and read the cash flow on every level of your Group, we would love to help you get started.

Authors:

Claus Finderup Grove, CEO at Konsolidator