Rethink the way you present data in your reporting

Combine, collect, prepare, present

the correct process of controlling and sorting relevant data in Finance

How do you ensure that your management report contains the correct information and clearly communicates the story your data is telling you? And how do you make a report impactful and straightforward, but not so simple or misdirected that people hunt for insights?

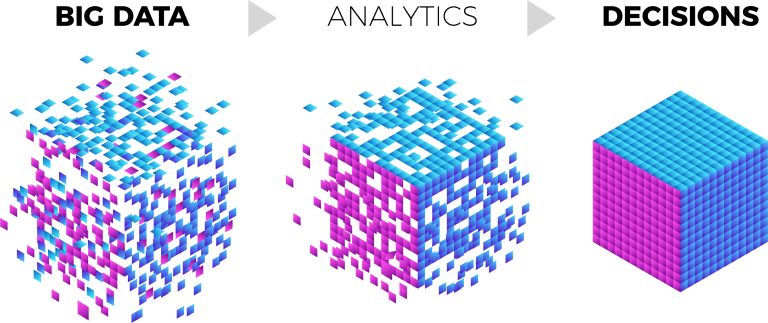

One vital part is to ensure you have the proper visual tools to present data to management. However, the full potential of your report is in the process before that. You must look at the process of controlling and sorting the relevant data first. It is all about establishing what data is required to tell the most impactful story making your management reports stand out.

The bottom line, before you investigate tools to support your data flow, ensure that you have a transparent process for how you handle these four critical parts of the data journey; Combine, Collect, Prepare, Present.

No. 1: COMBINE

- Access and automate data flow

- Use all internal data

- Connect data systems from all departments

How you combine data to strengthen the credibility

The first step first: combine and prepare the data flow. And when we say combine, we mean: Exploit all data in the organization and challenge the way you combine data right now. Crucial data storytelling comes from internal data, making it unique and original. By combining data from other departments like HR, you can find relationships and trends in numbers you have overlooked. And you might find the connection between what went well and what went wrong. Those who understand navigating the difference between strategic and operational data will perform well. And more importantly, you know it comes from a credible source, making it more impactful.

In Finance, the report is not better than the available data. And we generate an enormous amount in all parts of the business. If we mix that with the number of digital solutions available today, you can access all the data you need – and as a result, create more influential reports. So next time you collect data, e.g., from your ERP system, you need to look at two things:

- Is your data flow working and automated?

- Do you have access to all the data you need?

It is also easier to get more data and compare, e.g., numbers from the sales department if you automate processes. We can talk forever about the importance of automatizing as much as possible of your data flow. But that will take up too much space. Instead, get an overview of why data integration is essential here.

No. 2: COLLECT

- Don’t get stuck on finance KPIs

- Collect data to support strategic decisions

- Be specific when collecting data, but get it from every angle to support the success criteria

How you collect data and gain a competitive edge

The numbers you collect in your financial report will tell the best story the company can. But the key is to remember: it is all about the eyes that see. What makes sense for you might not make sense as quickly for everyone in the top management if it does not relate to what they are looking at, namely the strategy. So, step two means collecting relevant data for the people reading it. Consider:

- Is this relevant to management and the company’s KPI?

- Does it solve current challenges or provide further knowledge, e.g., tapping into a new market?

- Is this the same data they have seen before?

Management Reporting must be closely related to the strategy. And, more importantly, help the board make long-term decision-making. And still, only 24% of finance departments link their KPIs to those from the company strategy, according to PwC. Why? Because it isn’t until recently that we have seen the impact companies can have when the finance departments become involved in high-level decision-making. But it is here you can make a difference and give your company a competitive edge. So, ask yourself:

- Does my report reflect the strategy, including goals like new markets?

- What are the success criteria, market shares, growth in revenue, new customers, etc.?

- Am I providing feedback to existing KPIs, and do they need changes?

Your KPIs should move away from Finance specific and towards what you can do to support strategy. As a bonus, this will also help ensure your forecast planning focuses on these specific targets, e.g., how much revenue do we have to get before 31/12/2022?

If you have the data flow from all departments mentioned in the section above, your knowledge of numbers can turn your data into an easily digestible story. Make sure that the numbers collected speak to people so that they understand and provide as much context as possible.

Creating compelling data storytelling in your report doesn’t mean telling whatever story you want. It means you collect relevant data related to the people who will read it.

No. 3: PREPARE

- Investigate data relationships

- Use digital solutions to combine data

- Be clear in your data story, no data use that doesn’t relate to the KPI’s

HOW YOU PREPARE DATA

The third step to deliver a visual, comprehensive, and compelling financial report comes from how you prepare data. A convincing financial report ensures that the right and necessary information is available to the board to create direction for the strategic goals, etc., both on a strategic and operational level. We can all agree that all the information is essential in the reporting. But how do you ensure that the information you give is relevant and correct?

Understanding what type of data relationships to look for helps you find those stories faster. Here is why we argue automation and digital solutions are essential when you combine data. Here Konsolidator is an example of how a simple cloud tool prepares numbers for financial consolidation.

Because good data stories often come from more than just the numbers; they come from the relationships in data. When you combine data from across the business with the strategic goals, you begin to see how the numbers relate to each other.

No. 4: PRESENT

- Know how you want to visualize it, before transforming data

- Don’t overload with charts, revisit the strategy.

- Research templates e.g. Power BI

How you present data in the most digestible way

Before you even think of transforming your data into a visual report, you should know how you want it visualized.

If you know how and what to present, all your future processes and reports will be easier. It is not because we do not recognize the time it takes to set it up or develop a new template when we say easy. But because the alternative of sharing unclear or irrelevant information that the reader can misunderstand will get way more complicated. Including data that seems manipulated. And in the end – it will take up more time for the finance professionals than implementing visualization tools, standards, and processes.

You do not need to overload people with charts to make it understandable. Just revisit the strategy angle when you think of how to present the data. You need to visualize the success factors that ensure the upcoming strategy will succeed or look at elements that aren’t growing. Look at your data relationships for these KPIs.

Knowing what to present and how to do it will help you use your data visualization tool. If you want to know more about how software like Power BI can enhance your data’s appeal, understanding, and influence, read here. For the format, you can also find great templates, which can assist you in presenting the data in the most optimized and accurate form.