When the covid-19 panic is gone, finance should plan for the future

Use the crisis as the catalyst for long-term innovation!

Most things we cannot predict nor control in the current environment. So we need to focus on what we can control. And that is our reaction to it.

And this goes for Finance too!

The world is in chaos over Covid-19 now with billions of people being asked to stay at home. The public is closed meaning schools, shops, restaurants, and you name it. Each day new measures are introduced to contain the virus so it’s easy to start panicking over what’s happening and stress out at home.

For around the past month people have been asked to work from home, however, same time, they’re asked to take care of and home school their kids. In that situation you can’t really expect people to stay productive for long. These are indeed desperate times and therefore, it will require an extraordinary effort from all of us to get through it.

Right now, you’re likely asked to do scenario analysis, figure out how long your company can survive the shutdown, create new expense account to record the impact of the virus, etc. And you need to do all this from home with only virtual contact with your colleagues on a VPN that’s likely not running at full speed with everyone using it at the same time.

How are you ever going to manage this?

Use the crisis as a catalyst for long-term innovation

The truth is ..

no one could blame you for simply not managing. Many companies are in survival mode and no doubt that many of them will go bankrupt before this is over. Even the most well-run companies are struggling right now with no activity in society.

But what’s even worse is when the health crisis is over, you’d expect that a significant workload is awaiting the returning workers. For many it would be to get the company up and running again and for Finance it would be to estimate the damage, restate the expectations for the coming year, and start thinking of initiatives that can restore profitability.

So,..

if we are to survive this situation of currently not being very productive and suddenly be expected to become twice as productive, we need to think in new ways.

We need to work in new ways too and start using new tools we either didn’t consider before or kept postponing due to lack of time. This won’t happen overnight and will require innovative thinking from all of us. But it’s in crisis situations it becomes obvious to us what our weakest links are and where we get ideas about how to strengthen the company.

One example of this was a large Danish company that realized their VPN simply couldn’t handle the load of everyone working from home. Fast forward one day though and they’d already found a new software that could solve the problem.

We must avoid though to only think in short-term solutions. Now that there’s little to do in most companies it’s the perfect time to think of solutions that’ll make our companies stronger in the long run.

Now is your window of opportunity!

Just think about it.

Wouldn’t it be nice if we could come up with solutions that would make us more productive once everything is somehow back to normal?

For finance professionals here are some things you should consider;

- You’re currently modelling different scenarios about what will happen in the coming weeks – why not use the opportunity to build a better financial model that can help you do better planning in the future?

- You’re almost running out of cash and you’re starting to get creative – why not save all the ideas from your brainstorm for after the crisis where you can probably improve your cash management and funding setup?

- You’ve been asked to track the impact of the virus on your company and are scrambling to find all the needed information – why not seize the moment and improve your reporting capabilities for future requests for information?

There are likely hundreds of other things you could be improving for the long-term now and the impact could be dramatic!

Let’s talk about the productivity curve!

If you’re in Finance (or any other industry) you’ve likely noticed one graph that has been dominating the public debate the past few weeks. It’s the curve that shows the two main scenarios of the epidemic;

Scenario 1) where we do nothing and it spikes above what our healthcare system can manage.

Scenario 2) where we do whatever we can to delay the spread whereby flattening the infection curve and staying below the max capacity of the healthcare system.

But perhaps now it’s time for us in finance to be concerned with a slightly different curve. Let’s look at our productivity curve, and what happens if we manage to be innovative and develop new smart solutions in the current situation.

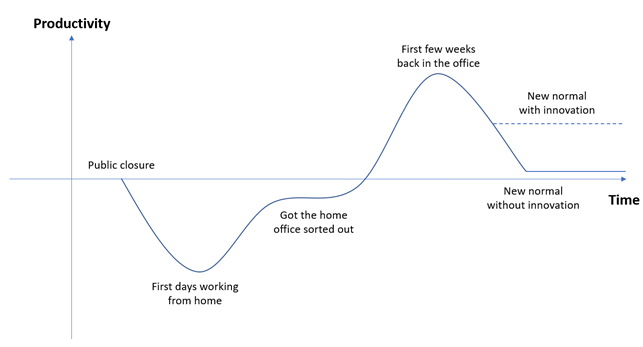

The productivity curve looks like this;

At first you were panicking about the public closure and having to work from home indefinitely (with the kids running around). And you just weren’t getting much done.

After a while you started to get organised and your productivity level increased, however, without ever reaching pre-crisis levels.

Once you will finally be back in the office again a mountain of work will await you, and you will have to work like crazy to keep up.

After a while a new normal will arrive and if you do nothing now your productivity will probably look like it has always done.

However, is that really good enough?

Shouldn’t we try to get some positive out of this situation and think in innovative ways that make our companies stronger in the long run?

This might not be the most natural thing for finance professionals to consider, however, our profession was changing even before the crisis. Instead of panicking and going in shutdown mode try something different.

Try to embrace this crisis to think in news ways. Think in innovative ways. Think for the long-term. Now is the time to not only make your company stronger but also to future-proof your career!

What are you working with at the moment?

Are you in crisis management mode?

Are you in a complete shutdown?

Or have you started to think about the future?

We are curious to hear what you’re up to and if we can do anything to swing you in a positive direction then consider it done!

Authors:

Claus Finderup Grove, CEO at Konsolidator

Anders Liu-Lindberg, Co-founder of the Business Partnering Institute.