08 Feb The Finance Professional’s 3 digital must-haves

Our main goal as finance professionals is to deliver accurate reporting. To do so, our tools for managing the reporting must help us facilitate fast and accurate results. In this blog post, we will look at:

- What tools you should have in your digital tool belt.

- How automating certain tasks of the reporting can increase efficiency.

- What software to look for when acquiring new software for your digital toolbox.

The 3 must-have types of tools

To deliver precise, on-time financial reporting, our finance experts recommend the following tools:

- A budgeting and forecasting tool (such as Phocas) is important to ease your job of predicting. This tool is becoming more vital to have in your toolbox since we are living in uncertain times, and an outlook for the business’ future becomes essential. Questions like: What assets to develop, where to cut the budget, and how to strengthen the position on the market are important to answer. To do so, the board and management need your data to build their decision on. A proper budgeting and forecasting tool will ensure you can provide decision-makers with the outlook needed to ensure a profitable future.

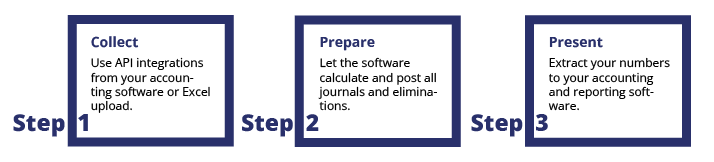

- A consolidation & reporting tool (such as Konsolidator) is the engine of your reporting machine. And thus, this software ensures that all your data is processed and correctly handled, so you don’t spend your precious time finding and correcting errors. Instead, the consolidation and reporting tool will enable you to dive deep into your data and deliver good management reporting. Once you get the extra time to dive deep into your data and pull out interesting results, the next tool on our list becomes very important to have in your toolbox.

- A visualization tool (such as Power BI) is important for showcasing interesting results. That is so since we often have to explain our data to people outside of finance. Since not all within the organization have the time or skill to look into a data-heavy spreadsheet, a visualization tool is of great help. So, when you want to make a clear point about the development, you see in the output of your processed data this is the tool for driving financial proposals.

These 3 tools are simply the must-haves of finance professionals. But there are different ways of acquiring them and different types of software. So how to know which one to choose? In the coming sections, we will talk about what software is suited for finance and why you should automate some aspects of the reporting besides the above tools.

Acquiring software for finance

Getting software to do the job for you can be defined as automating tasks. And you will find many aspects of the reporting you can easily automate. We have an extensive list of repetitive, data-heavy, and redundant tasks in finance. Nevertheless, some tasks just have to be done to complete the reporting process. In this section, we will discuss the benefits of automating these tasks and the different types of software for doing so.

The benefit of automating certain tasks

The huge benefit you gain from automating tasks is time, which is often a limited resource in the finance function. When we talk about automating tasks, we mean removing repetitive, redundant tasks from your workflow. Basically, we talk about taking a task like manually discovering and retyping a broken formula and letting a computer do the job.

If you have software in place to relieve your workload within certain aspects of the reporting process, you will have plenty of time for the financial analysis. Which, in the end, will benefit your business and stakeholders. Hence the benefit of automating repetitive, redundant tasks.

Benefits of using cloud software

Cloud software provides several benefits compared to non-cloud software. Below we will list a few of them and explain how cloud software can help you in your daily work. What is important to understand is that cloud software work like apps. That means that cloud software easily integrates since all you need is an API or built-in feature to make two pieces of software link with each other. For instance, you find the Cloud consolidation and reporting tool Konsolidator integrates well with Xero’s cloud ERP system.

Cloud software provides benefits such as:

- Quick access to your data: All you need is internet access, and then you can access your software and data whenever and wherever you want. This makes working hours more flexible.

- The latest software updates: No software maintenance is required on your part. Your supplier will handle this, and you will get the updates for free as they are released.

- Lower cost: Most cloud software is based on a model where you pay a monthly subscription. Making the cost low and easy for you to quit the software if you no longer need it.

- High level of security: Your supplier will handle the security, and tech companies are experts on the security level. And have skilled employees dedicated to this task only.

- More efficient workflow: Most cloud software has built-in multiuser functionality as a standard. This means several employees can work in the same program doing different tasks without affecting the work of their coworkers.

All the points above embrace the essence of automating tasks, which makes the workflow more flexible, efficient, and smooth. Cloud software is becoming the new normal – not only in finance but in the software world. So, if you are thinking of automating some of your tasks through software, we suggest you choose cloud software.

Examples of cloud software in Finance

Here you will find a list of cloud-based software to use in the finance function.

- Visualization tool (Power BI)

- ERP system (Xero, Economics, QuickBooks)

- Planning tool (Outlook)

- Budget and forecast tool (Phocas)

- Consolidation & reporting tool (Konsolidator)

Create a strong digital toolbox to succeed in driving decision-making

To create a strong digital toolbox, you must have a:

- Consolidation and reporting tool

- Visualization tool

- Budgeting and forecasting tool.

The 3 tools will strengthen your performance as a Finance Professional since you will be able to deliver much more precise, on-time financial reporting. Furthermore, you will gain time for much more creatively and cognitively demanding tasks, such as diving deep into data and presenting business proposals based on your financial insights. Thus, helping management and the board to make decisions that will strengthen the business. Via the help of your digital toolbox, you will be the driver of data-driven decision-making.