26 maj What is on the CFO agenda right now?

What business skills do finance professionals need in 2021?

What is on the CFO agenda in 2021 and how will it shape your role as a finance professional moving forward?

The questions are many right now as the role of the CFO and the finance team is changing and as the change is happening at a fast speed.

Put in short in 2021 the finance function is expected to play a much more dynamic role in driving both innovation and strategic decisions and this undoubtedly calls for new skills, and new ways of thinking. And to support this new technology is the answer. It is the answer to becoming more innovative but it is also the answer to becoming more strategic.

You can compare the technological changes that we are seeing in finance right now to the technological development we have seen in the music industry.

In the music industry we moved from LPs to CDs, iPods and MP3 players to now streaming music on our smartphones though only streaming services. The change (that happened gradually in the music industry) is the same we see in finance today. The only difference is that it took around 20 years for the music industry to evolve into where the business is at today. So, within the music business employees were able to adjust to each change and step little by little.

When looking at finance the change – is happening much faster.

There is nothing gradual about it.

How do you make sure you are keeping up to speed and staying relevant within the new finance department?

The speed of change can be quite daunting. Not only is the change happening quickly but you as a professional, your skills and competencies must evolve at the same pace. The finance team is relied upon as a trusted business partner. It is crucial that the leading management knows if they are making the right decisions on behalf of the entire organization. That is why they need the finance team to produce and present financial insights that validates what the next move should be for the business.

The finance department is as a result becoming drivers of data drive decision making. It is no longer enough to sit behind your desk and crunch numbers all day long. You have to present insights, thoughts, rational thinking, and conclusions which the leading business management can relate to and use for decision making.

To produce what your management need and to stay relevant when the technological wave hits the finance department, you will need to get out of your comfort zone as a traditional CFO or finance professional.

How does the classic profile of a finance professional align with the new requirements?

To understand how you step outside of your comfort zone let us first take a look at how the traditional profile of a finance professional looks like.

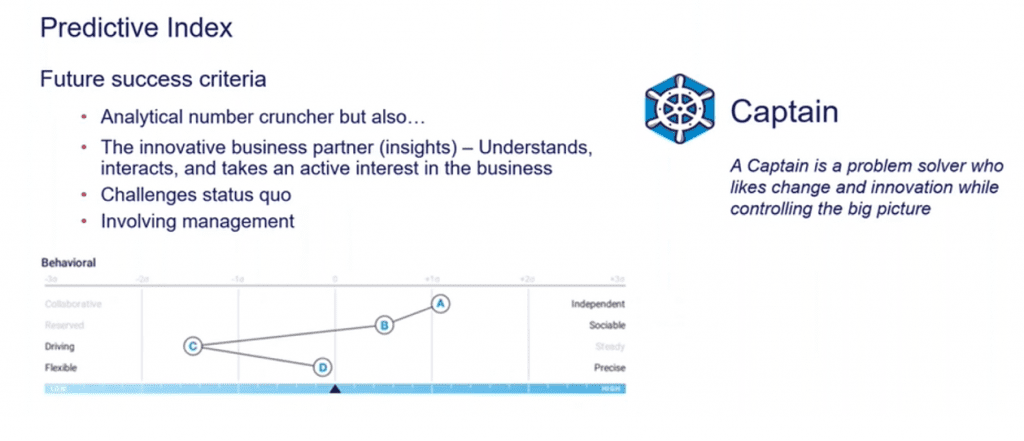

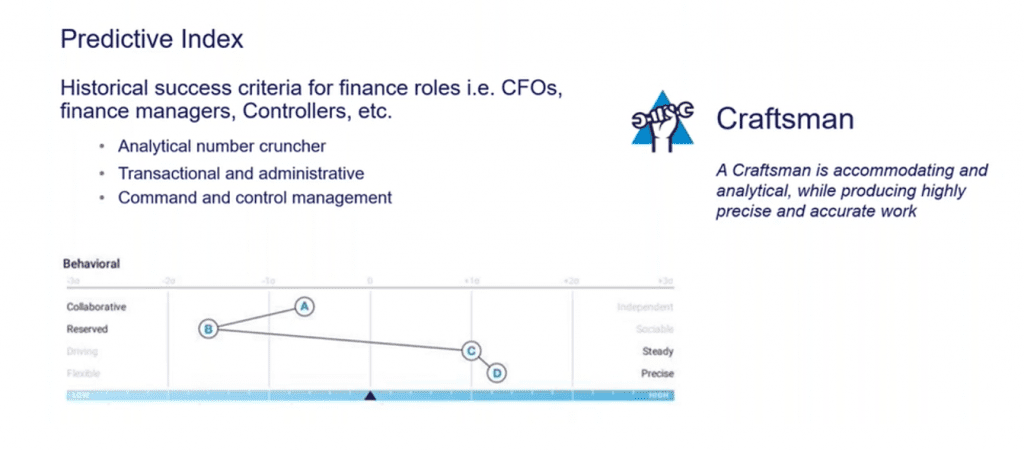

For this we have looked into the personality test tool Predictive Index that we use to understand both how we put together people and teams to understand specifically what drives behaviors at work.

After a thorough analysis of millions of Behavioral Assessments, the predictive index science team has identified 17 “Reference Profiles” that create a behavioral map for different types of people.

The classic profile that we see in finance professionals is the profile called the Craftsman.

The Craftsman has a high set of analytical skills, loves to produce precise data, is detail oriented, loves control, and to has a steady and comfortable way of working.

But to accommodate the changes we are now seeing occurring we also see the skillset of the finance professional starts to shift towards the Captain profile.

The Captain profile is a problem solver, likes changes and innovation while controlling the big picture. This profile still needs to be analytical, but also needs to understand how to be interactive with the wider business and deliver insights into the organization.

To better understand how you can be an asset to your business here are some steps you have to keep in mind for changing the way you think and work as a finance professional today.

To become the finance professional of tomorrow (the captain) you need to:

- Get out of the reactive mindset of finance and start to be more proactive in your thinking.

- Report on what is happening (or what might happen)rather than just reporting on what has happened.

- Deliver insights, not reports. Insights is when you have information which your leading managers does not know about, but which can help them make better decisions. Reports is loads of columns with numbers in. You need to know the difference.

You also have to move from spending most of your time on accounting and reporting, data and transactions (and it is here new technology comes into play to support you) to spending more time on insights and influence, analyzing and forecasting. Data, reports and analysis are important because you cannot be a finance business partner without the numbers and the data to back up your insights. But where you can really make a difference is when you share these insights, make recommendations, and influence the management’s decisions so they make better decisions and execute better.

As with any other major changes you can do it all over night, it all starts with micro steps. The idea is that you break your plan into minor bits and create sub goals and implement micro steps of the week, so you see a result little by little and not just at the finish line after two- or three-years’ time. Not to see any progress can be very demotivating so break it down into so small bits, so you can see yourself moving closer to the overall goal.

Data is continuously updated as you get new data into your Konsolidator Data warehouse

Data is continuously updated as you get new data into your Konsolidator Data warehouse